The Micro, Small and Medium Enterprise sector is crucial to India's economy. There are 55.8 million enterprises in various industries, employing close to 124 million people. Of these, nearly 14 percent are women-led enterprises, and close to 59.5 percent are based in rural areas. In all, the MSME sector accounts for 31 percent of India's GDP and 45 percent of exports. Lack of adequate and timely access to finance continues to remain the biggest challenge for the sector and has constrained its growth. The financing needs of the sector depend on the size of operation, industry, customer segment, and the stage of development. Financial institutions have limited their exposure to the sector because of small ticket size of loans, higher cost of servicing the segment, and limited ability of MSMEs to provide immovable collateral.

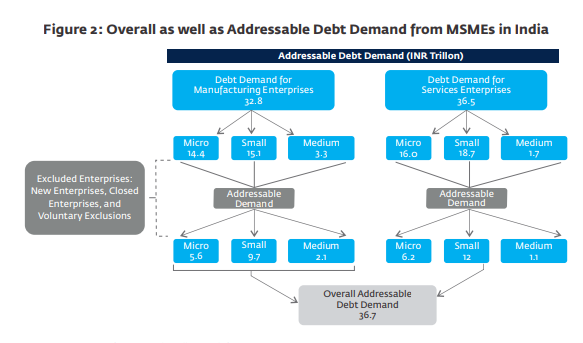

The overall demand for both debt and equity finance by MSMEs is estimated to be INR 87.7 trillion (USD 1.4 trillion), which comprises INR 69.3 trillion (USD 1.1 trillion) of debt demand and INR 18.4 trillion (USD 283 billion) of equity demand. To estimate the debt demand that Financial Institutions would consider financing in the short term, the study does not take into account the demand from the enterprises that are either not considered commercially viable by formal financial institutions, or those enterprises that voluntarily exclude themselves from formal financial services. Thus, after excluding (a) sick enterprises, (b) new enterprises (those with less than a year in operation), micro service enterprises that prefer finance from the informal sector, the viable and addressable debt demand is estimated to be INR 36.7 trillion (USD 565 billion). This is 53 percent of the total debt demand.

This study shows that of the overall debt demand of INR 69.3 trillion (USD 1.1 trillion), a major part – 84 percent or INR 58.4 trillion (USD 898 billion) – is financed from informal sources. Formal sources cater to only 16 percent or INR 10.9 trillion (USD 168 billion) of the total MSME debt financing. Within the formal financial sector, scheduled commercial banks account for nearly 81 percent of debt supply to the MSME sector, contributing INR 9.4 trillion (USD 144.3 billion). Non-Banking Finance Companies and smaller banks such as Regional Rural Banks (RRBs), Urban Cooperative Banks (UCBs) and government financial institutions constitute the rest of the formal MSME debt flow. Within the informal financial sector non-institutional sources include family, friends, and family business, while institutional sources comprise moneylenders and chit funds.

| Small Business Loan | |

|---|---|

| Purpose | For business expansion only |

| Loan Type | Group Loan (Size 3-20 Members) |

| Loan Security | Secured by Stock |

| Hypothication | Against hypothecation of stock |

| Target Segment | Self Employed |

| Credit Check | Yes - (Equifax & CIBIL) |

| Documents Required | UID of Both, PAN Card, Business Proff, Business Snap, 3 Chq. Etc. |

| Guarantor | Spouse co-borrower mandatory |

| Loan Term | Income Generating Loan | Micro Enterprises Loan |

|---|---|---|

| Ticket Size | Rs.10000-45000 | Rs.50000-100000 |

| Repayment Period in months | 12-24 Months | 18-24 Months |

| Rate of interest | 26% to 30% | 28% to 30% |

| Total Charges(PF,GST, Insurance & Other Charges) | 6% | 6% |